Hollywood screenwriter William Goldman (All the President’s Men, The Princess Bride) famously said that “nobody knows anything” when it comes to what works in Hollywood. Despite decades of experience, no one in Hollywood had any idea what was going to be a hit and what was going to be a flop.

During the first half of 2020, the stock markets have provided us with both a flop and a hit, and many are scratching their heads as to why we’ve seen such a strong rally since March 23rd. On the surface, with an economic shutdown and uncertain progress controlling COVID-19, the current rally can seem divorced from reality. But a closer look at the underlying components – congressional stimulus, Federal Reserve support, market make-up, and investor time horizons – paints a clearer picture.

CONGRESSIONAL STIMULUS

Clearly, the passage of the CARES Act put the brakes on the market’s swift decline. The consensus in the markets seemed to be that the package would not prevent a recession, but would be enough to prevent a potential plunge into a depression. The Act was passed by the Senate in the early morning hours of March 25th, so it is no coincidence that March 23rd marked the bottom of the initial pandemic decline.

THE FEDERAL RESERVE

Support from the Fed falls into three categories: interest rates, loans, and purchases. The purchase and loan activities are largely aimed at ensuring the financial machinery underlying the economy continues to run smoothly. The Fed’s aim is to ensure banks continue to make loans, money markets function smoothly, and banks remain liquid. They did so with a patchwork quilt of programs that are identified by a bewildering array of acronyms including QE, PDCF, MMLF, PPPLF, CPFF, PMCCF, SMCCF, TALF, and MLF. (Yes, really.)

For the most part, these programs don’t directly impact the publicly traded companies that make up the market. But the swiftness of their implementation and the breadth of the support reassured investors that the economy would hold steady.

INTEREST RATES

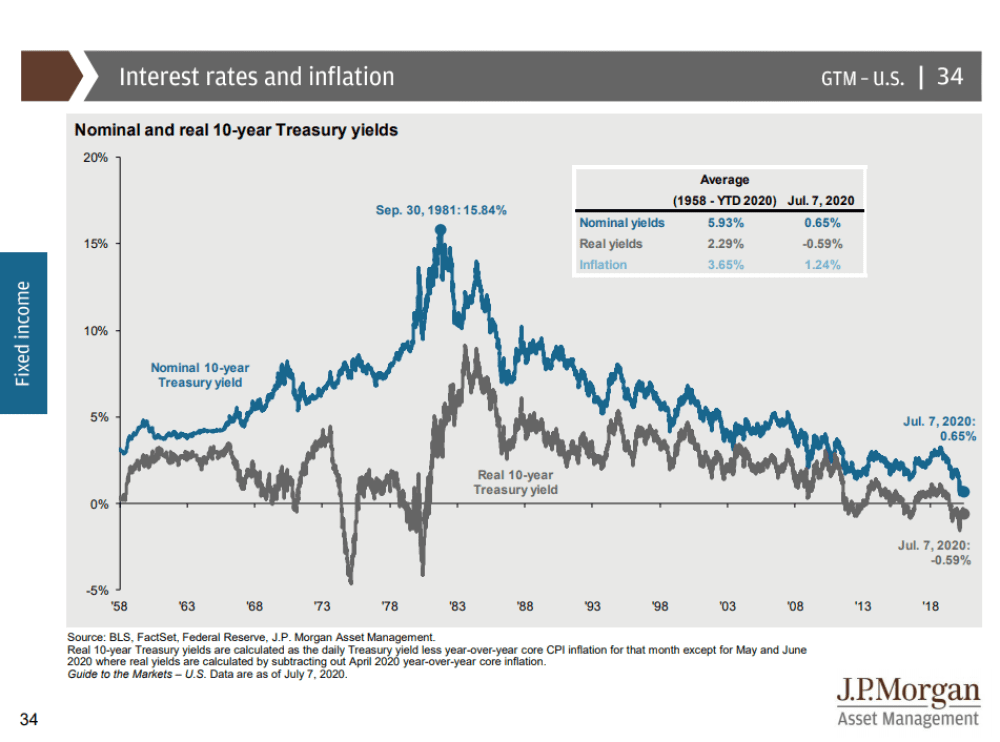

The Fed also lowered interest rates, which has a more direct, though nebulous effect on stock markets. As the Fed lowered its key interest rate to near 0%, interest rates on savings accounts, money markets, and bonds dropped in response. This has a secondary effect of encouraging savers to put their money back into stocks.

At the beginning of July, 10-year Treasury bonds were paying 0.65% interest. Meanwhile, the S&P 500 Index had a dividend yield of 1.94%. Thus, investors interested in income could get more than three times as much income buy putting the money into stocks. In short, investors are getting small reward for an investment in bonds, pushing even those focused more on income than growth to buy stocks.

WHAT EXACTLY MAKES UP THE MARKET?

Wall Street and Main Street aren’t as similar we might think. A quick look at the information technology and real estate sectors illustrates this pretty clearly. IT companies make up 26% of the U.S. stock market (the S&P 500 Index), but somewhere between 3% and 5% of the economy as measured by GDP. On the flip side, real estate activity makes up around 14% of U.S. GDP, but just 1% to 3% of the stock market.

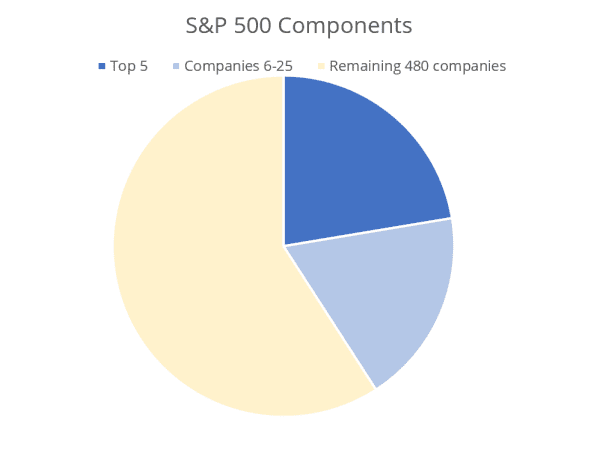

Looking at the makeup of the S&P 500 Index as a whole, we can see the rally may not be quite as irrational as it seems. The five largest companies in the index – Microsoft, Apple, Amazon, Facebook, and Google – account for just shy of 22% of the index. If we extend that out to the 25 largest companies, they make up 40% of the index.

In other words, because the S&P 500 Index weights companies by their size, 1% of the companies make up 22% of the index, and 5% of the companies account for 40% of the index. The largest companies have an outsized influence on the return of the index each day. Those top five companies are well equipped to remain successful during the pandemic. Similarly, in the top 25 we see names like Johnson & Johnson, Visa, Intel, Verizon, Merck, and PayPal. Therefore, the movement of the S&P 500 following the March 23 low reflects in part the strength of the tech and healthcare companies at the top.

It can be hard to mentally account for this, when we look around at the most obvious effects of the pandemic. Most reading this will have stayed at a Marriott property at some point in their lives, a company that is headquartered close to home here in Bethesda. They are obviously suffering mightily during the pandemic. But, as large and familiar as they are to most of us, they make up just 0.09% of the S&P 500 Index. The hardest hit areas of the economy, including service and retail, are either small portions of the market, or like many of our favorite restaurants, outside of the stock markets entirely.

LOOKING OVER THE VALLEY

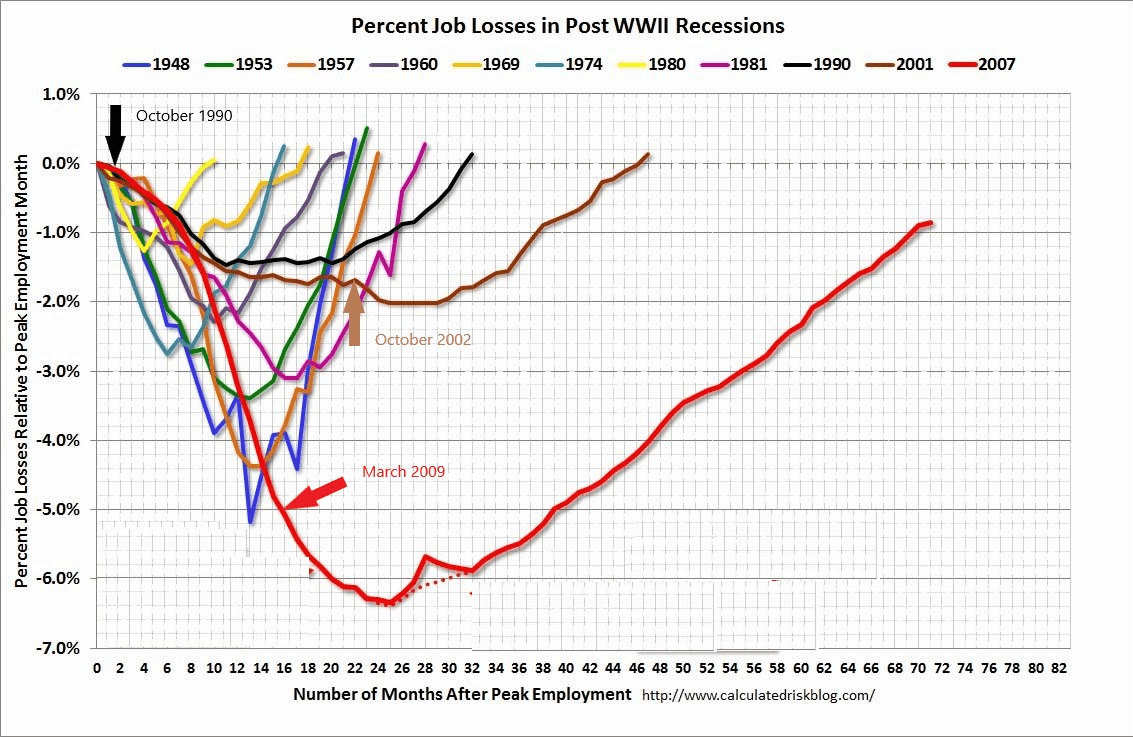

Cullen Roche of Pragmatic Capital recently noted that “the stock market doesn’t wait for the economy to get better, it anticipates it.” We can see one illustration of this if we look at the job losses during the last three recessions – 2008, 2001, and 1990. The chart below from Calculated Risk tracks the recovery of jobs in every recession since World War II. For the last 3 recessions, I’ve inserted an arrow, illustrating when the markets hit their low and began to recover.

In each case, you can see the markets began to move back upward well before job losses stopped, let alone before the lost jobs were recovered. In 1990, the markets began moving higher in October, though job losses kept mounting through July of 1991.

Similarly, in 2002 the market recovery started in October, though unemployment got worse through August of 2003. Most recently, during the Global Financial Crisis, the market hit bottom and started its move upward in March 2009, despite the fact that massive (at the time) job losses continued through the end of the year, and it wasn’t until March 2010 that the pain stopped.

INFORMATION CASCADES

None of this is meant to say that the current market rally is perfectly rational and sustainable, and that trouble is behind us. There is ample historical evidence going back to the tulip mania of the 1600s that we overdo our despair during times of difficulty and overdo our exuberance during times of recovery. During extremes, people’s beliefs become homogeneous, leading to information cascades. One of the features of an information cascade is that at some point, no new information is being added, and individuals just imitate others, based on the belief that such a large number of people can’t be wrong.

You can fill a library with all the books written to explain why this happens, how to stop it, or how to capitalize on it. And yet, for the most part, nobody knows anything. There is every likelihood the current rally will fizzle out at some point and we’ll pull back, before moving forward again. But based on historical evidence and the makeup of the market, the current rally may simply be a bit overdone, rather than divorced from reality.

By Chris Rivers, CFP®, CRPC®