Many investors are concerned about what a sustained rally in interest rates could mean for the stock market. Bond yields have been climbing with optimism for an economic revival following the year of the pandemic. When you think of rising rates, you think of higher borrowing costs, which doesn’t sound great for stocks. Higher yields can also mean bonds are a more attractive investment, which also doesn’t bode well for stocks. We’ve also seen stocks trade lower over the past month as yields surged. However, markets aren’t this simple.

RISK AND RETURN

Rising bond yields can have two negative effects on stocks. For one, they lessen the appeal of stocks. When investors are considering stocks, they insist on a higher return for taking the risk in comparison to the return of risk-free government bonds. As the yield on risk-free government bonds increases, so does the return investors require to take on the additional risk that comes with stocks. This increased required return has a negative effect on stock prices. Secondly, rising rates mean higher interest on debt, making it harder for companies to borrow money for growth.

PATIENCE IS A VIRTUE

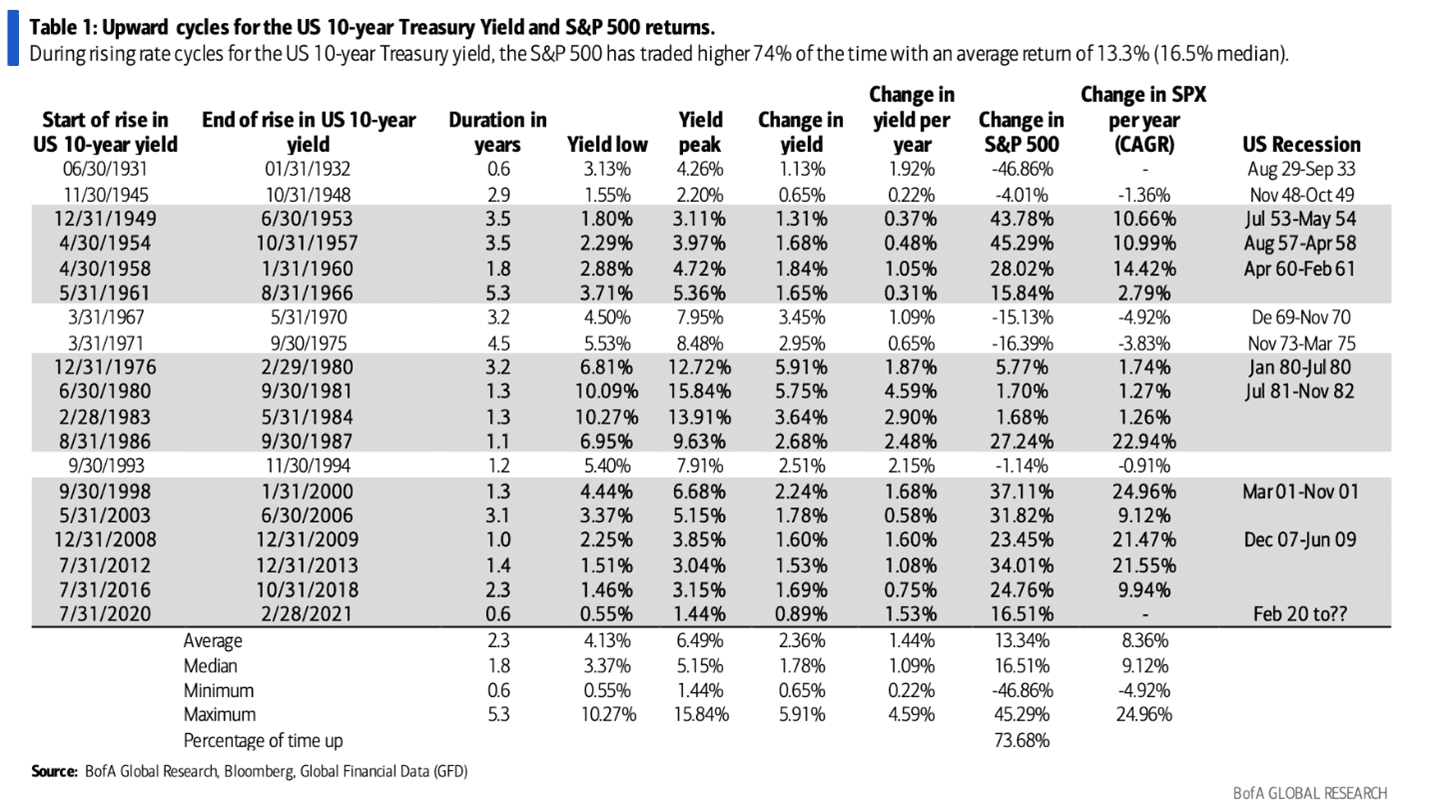

With that said, rising rates are often good for the stock market. History shows us that the stock market as a whole does well when bond yields rise. This makes sense when you think about it, as rates typically increase when growth expectations are improving. During times of economic recovery, investors are betting on increased spending, growing wages, and growing company earnings. All of these have positive effects on stock prices. Over the past 10 years, the most favorable environment for equity fund inflows has been when rates are rising. In a study analyzing seven prolonged periods of rising rates since 1990, the S&P 500 climbed at an average annualized rate of 15.1%. The chart below proves this point further.

If an improving growth outlook is partially responsible for driving rates higher, it should also support corporate profits, which creates a positive backdrop for stocks. It’s also important to remember that the starting point for interest rates right now is already low. Rates have been rising, but they are still historically low, as the 10-year Treasury yield falls into the bottom 2% of all values dating back to 1962. While rising rates can have negative impacts on stocks, history has shown us that in environments similar to the one we’re in today, geared for economic recovery, stocks can continue to thrive.

Presented by Elizabeth Schleifer